For over 45 years, Boston Trust Walden has maintained an investment approach focused on identifying companies exhibiting high financial quality with sustainable business models whose stocks are trading at reasonable valuations. And yet, we also appreciate that market dynamics can shift over time—perhaps inexorably—which is why our definition of quality is itself dynamic and able to evolve.

One of these shifts began gradually years ago but has accelerated more recently: increasing digital disruption that has led to a greater component of firm value attributable to intangible assets.

A rise in companies that have created multi-sided platforms that enhance scale and network effects has led to increased industry consolidation and winner-take-all endgames in markets such as e-commerce, online advertising, and social media, demonstrating the value of such intangible assets. While certain natural monopolies such as railroads have existed for decades, the rise of digital technology and intangible asset value has created a new cohort of modern natural monopolies as well.

Platforms (intermediaries that connect multiple groups of users) have existed for years, decades, centuries, and even millennia: the earliest bazaars connecting producers and consumers originated thousands of years ago. Today, technology has enhanced the reach, scale, and efficiency of platforms; indeed, we can connect with friends, families, and businesses via digital platforms in ways unimaginable even a generation ago. Many of these platforms have also turned into the equivalent of modern monopolies that benefit from scale, consolidation, and strong network effects as users of the platforms attract more users. At Boston Trust Walden, we seek to identify mechanisms such as these by which a company may sustain its success.

Whether companies that have dominated due to the rise of their digitally enabled platforms—including several of today’s largest companies—will continue to increase their scale or face regulatory challenges remains a question. Regulatory risk represents but one type of investment risk we attempt to understand as part of our analysis of business model sustainability. We often ask when analyzing a company how consolidated the playing field is, to what extent the environment favors incumbents, and what forces—including competitive or regulatory threats or even societal reaction—may disrupt the flywheel that has led to dominance.

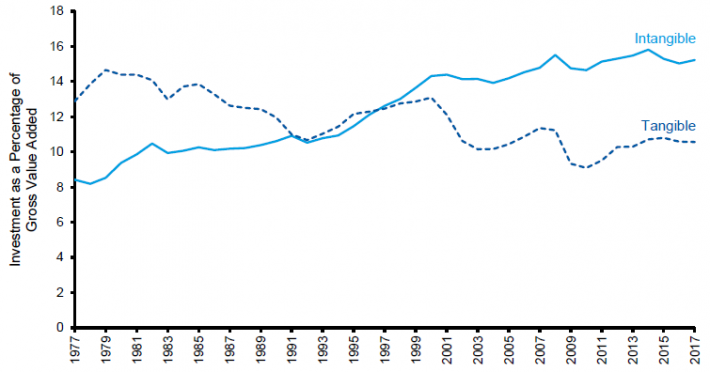

Another reason why the rise of platforms and winner-take-all outcomes matters is that investors’ perception of what constitutes the greatest firm value has shifted from a focus on tangible assets to intangible assets, as the chart below illustrates. For this reason, at Boston Trust Walden, we focus on free cash flow and net income rather than hard asset value in our valuation framework (read our post “We View Value a Little Differently“). One reason for this is that relatively asset-light businesses may not need to invest as much in physical investments such as machinery or equipment, though may invest instead in research and development, adversely impacting short-term earnings. Traditional financial statement metrics may obscure the latent value of intangible assets as investor perception of value migrates from tangible assets to intangible ones. Key intangible assets such as corporate know-how, management intelligence, strong cultures, workplace safety, effective supply chain management, prudent usage of information technology, and the like may matter even more in an increasingly service-oriented, asset-light economy, and these intangible assets often don’t have an obvious line item on firms’ balance sheets or get reflected explicitly on any financial statements. Part of our assessment at Boston Trust Walden involves incorporating traditional accounting metrics, free cash flow, and any latent intangible assets that may have material embedded value.

The Rise of Intangible Investments in the US, 1977 – 2017

Our role as investment manager entails recognizing the substantive changes taking place in our society and investing with an appreciation of where growth and value creation may come from amidst a backdrop of consolidation, winner-take-all industry structures, and a migration toward more asset-light business models. For over 45 years, we have anchored our investment philosophy on favoring high quality, sustainable businesses at reasonable valuations, and we will continue to do so with an eye toward appreciating what quality and sustainability mean in an evolving world.