Can a strategy have a “high quality” and “value” security selection discipline at the same time? As a portfolio manager for the Boston Trust Walden Large Cap Value strategy, I hear this question frequently. After all, on a personal level, almost every one of us has a story of buying the cheaper version of two items only to regret not spending more when the product didn’t live up to expectations. The good news is that we can identify stocks that meet our criteria for both value and financial quality. How we do that highlights a difference in how we think about value in contrast to our benchmark, the Russell 1000® Value Index.

The first step to understanding this difference is to examine how the benchmark is defined. Most institutional investors evaluate large cap value strategies against the Russell 1000® Value Index. In order to achieve its value tilt relative to the broader Russell 1000®, the index systematically includes “companies with lower price-to-book ratios and lower expected growth values”.1

Russell 1000® Value Index: Quantitative Approach

- Companies with lower price-to-book ratios

- Companies with lower expected growth values

This association of value with a lower price-to-book ratio is common in the industry, and the ease of calculation makes it a good fit for a rules-based index. However, a price-to-book approach alone doesn’t indicate any preference for quality, as investors may receive a lot of book value (i.e. equity) per each dollar invested, but there is no information as to how effectively the companies use that equity capital to generate economic returns (i.e. return on equity, economic value added, etc.).

The index construction component of lower growth exists as a mechanism to distinguish the Russell 1000® Value Index from its Russell 1000® Growth counterpart. While value isn’t typically associated with the fastest growing companies, investors might be surprised by the extent to which value indices systematically score growth as a negative factor. If you believe, as we do, that the ability to grow is an indicator of a business’s quality, it becomes clear why value investing, at least as defined by the Russell benchmark, is commonly associated with a preference for investing in lower quality companies.

At Boston Trust Walden, we believe value and quality can not only coexist, but that they are symbiotic. Warren Buffett said the intrinsic value of a business “is the discounted value of the cash that can be taken out of a business during its remaining life.”2 In accordance with this definition, we seek to invest in stocks with attractive “value” relative to price. More specifically, we look for companies that generate substantial earnings and cash flow up front. Then, we assess the ability of those companies to sustainably grow the cash flows over time. Using this framework, our different view of value compared to the benchmark becomes clear.

Boston Trust Walden Large Cap Value: Fundamental Approach

- Higher quality companies that can sustainably grow cash flows over time

- Stocks with attractive valuations, identified through a comprehensive analysis of fundamentals relative to peers, history, and prospects

Doing this in practice is not easy, requiring in depth reviews and monitoring of each investment. It would be difficult for any benchmark, which must rely on a rigid construction methodology, to replicate such an approach.

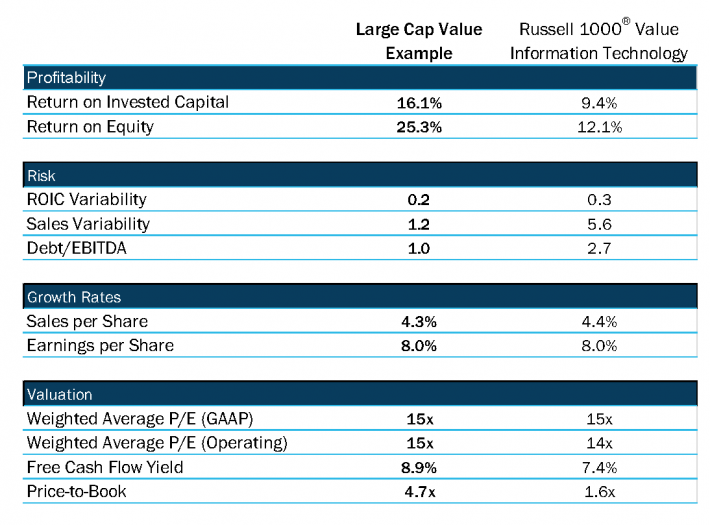

In order to illustrate this, we profile a networking equipment and services company held in the Boston Trust Walden Large Cap Value strategy. This technology company does not meet the Russell 1000® Value Index criteria for growth and valuation, and is thus not included in the benchmark. This exclusion may be due to its price-to-book ratio of 4.7x vs. the Russell 1000® Value at 1.6x. However, note in the table below that it is discounted relative to the benchmark according to all the other valuation measurements.

Characteristics of a Portfolio Company Excluded from the Russell 1000® Value Index

We believe this is because the company uses its book value more effectively in generating earnings, which, combined with indicators of lower risk, suggest an above-average quality profile. Furthermore, while we are always cautious in making bold predictions, we expect a number of the secular tailwinds that have benefited the company in the past to continue, including the upcoming rollout of the 5G wireless standard and the resulting need for network upgrades. Suffice to say, companies like this with high financial quality coupled with what we believe to be sound valuation are our target focus as value-seeking investors.

The Russell 1000® Value Index is a tool that large cap value investors can use to assess their managers’ performance. We encourage investors to understand the methodology used to construct this index and to recognize that it lacks several factors we associate with enduring value, including higher financial quality. Identifying companies with sustainable cash flows and attractive valuations, and assembling them into a diversified portfolio, is a hallmark of our approach. It is this simultaneous combination of quality and value that differentiates the Boston Trust Walden Large Cap Value strategy from its benchmark and underpins our investment objective to generate superior returns with less risk over full market cycles.