Financial Markets

Last year’s stock market rally continued unabated in the first quarter of 2024 as the S&P 500 Index rose 10.6%. The ascent continued to be disproportionately concentrated among a handful of massive technology-related companies. The leadership of the so-called Magnificent Seven, which accounted for much of last year’s gains, was narrowed to an even tighter quartet of mega-cap tech companies (NVIDIA, Microsoft, Meta/Facebook, and Amazon) that together accounted for almost half of the S&P’s first quarter return. With continued gains among the largest companies, the S&P 500 has become increasingly concentrated; the 10 largest companies now account for a full third of the Index. Other segments of the market that do not have such a concentration of mega-cap tech — including US small cap as well as international developed and emerging markets — underperformed the S&P 500.

Bonds also underperformed in the quarter. Evolving expectations for the path of policy interest rates from the Federal Reserve caused rates to rise — almost in unison across the maturity curve. The benchmark 10-year Treasury bond ended the quarter yielding 4.20%, up 0.32 percentage points during the period. As investors continued to embrace risk assets, credit spreads tightened further and aided corporate bond returns. All told, however, the rise in yields led to a negative quarterly return for most broad bond indices, with the Bloomberg US Aggregate down 0.8%.

Investment Perspectives

The Rate Cut That Wasn’t

In the final quarter of 2023, comments from the Federal Reserve indicated that the historical run of interest rate hikes was coming to an end. Though Chairman Jerome Powell sought to provide wiggle room for the monetary body — primarily by noting that policymakers remained data-driven and would set rates in line with its broad mandate of stable prices and full employment — the die had all but been cast. Many investors went further, however, interpreting Powell’s comments not only as a proclamation that rate increases had ended, but also as a signal that rate cuts would be coming soon. Going into this year, market expectations, as expressed by Fed Funds Futures, called for the Federal Reserve to start lowering its benchmark rate by March. And not only did investors expect the Fed to lower rates soon, but to continue doing so rapidly — reducing the policy rate by 1.5 percentage points by the end of 2024. Both elements outpaced the aggregate expectations of the policymakers themselves. Only three months hence, we have more validation for the adage, “Don’t fight the Fed.” Those market forecasts for cuts have indeed proven to be overblown, and forward expectations have changed materially. Fed Futures now indicate expectations for the Fed to begin cutting rates in June, at the earliest, and for the Fed Funds rate to be reduced by roughly half of what was previously expected by year-end.

So, what shifted? Well, not the economy. Its continued growth surprised many economists and investors who saw a high probability of recession not long ago. Such resilience is part of what drove stock returns over the past year, and the most recent quarter. And the economy is expected to continue expanding through 2024, albeit at a moderate pace. According to Bloomberg, the consensus forecast from economists is that US GDP will grow by 2.2% in 2024, up from a forecast of only 1.3% at the start of the year. This suggests that the Fed will feel less pressure to cut rates to avoid a recession.

At the same time, inflation pressures remain. Though rates of broad price increases are well off their 2021 highs that reached the high single digits, they have yet to return to the Fed’s 2% long-term target. Accordingly, and with the Fed seemingly convinced that the current level of rates does not present a high likelihood of pushing the economy into recession, we believe the Fed has little rationale for cutting rates aggressively in the near term. However, the economy may not be quite as resilient as it has been over the past couple of years, and the job market may be a key area to watch.

An Enduring Labor Market

The strength of the labor market has been a major element of the post-pandemic economic expansion. The unemployment rate has remained under 4% since early 2022, while the participation rate (the percentage of working-age adults who are either employed or looking for employment) has continued to claw back from the considerable drop experienced when many left the workforce in the throes of the pandemic. Moreover, hiring has broadened. Though industries like healthcare and hospitality led the labor recovery, we are now seeing openings and hirings in other parts of the economy. Even the construction industry, despite the headwind of higher borrowing rates, is showing impressive vigor.

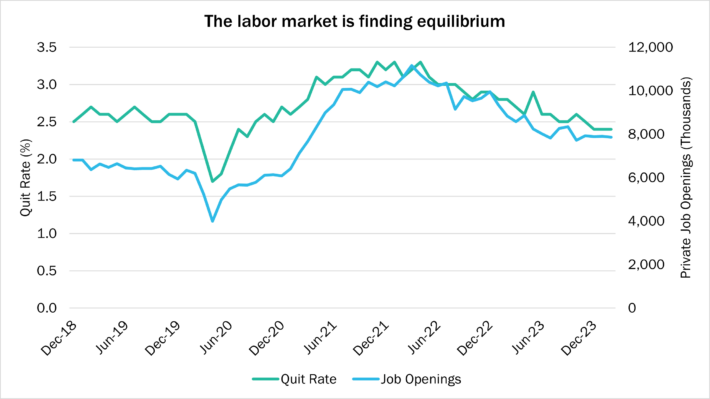

Despite these strong numbers, there are some indications that the labor market is not as frothy as it has been in recent years. Companies are not as desperate to hire new workers: job openings remain elevated but are nonetheless down almost 30% from their peak level in early 2022. And workers are finding fewer opportunities better than their existing jobs: the quit rate has been on a glide path lower and is now back down to prepandemic levels. Aggregate hourly wages, a key measure of worker bargaining power, are still growing at a healthy 5% rate, but that has moderated substantially from the pay increases that workers were achieving in the last couple of years. That all these key metrics have come off their strongest readings is not to suggest that the workers, or the economy overall, are in for a rude awakening. It does, however, indicate that the all-important labor market is finding more equilibrium, much like other aspects of the economy have found in recent quarters. Should the Fed see signs of more full-fledged weakening, we suspect it will offer its support by lowering interest rates.

Outlook and Positioning

We continue to see the economy on sound footing, with slow, steady growth as the most likely path in the near term. Should cracks begin to form in that foundation, we expect the Fed to react accordingly, providing a backstop in the form of lower interest rates. But stocks have broadly priced in such benign conditions, and after an impressive run, now sport aggregate valuations above long-term historical averages. We continue to avoid shares with speculative valuations and remain steadfastly focused on owning diversified portfolios of high-quality businesses. Historically, this discipline has reduced portfolio volatility and stemmed losses in times of market stress. Moreover, the lower-risk tenor of the equities we hold permits us to continue to overweight stocks in multi-asset portfolios without assuming excess risk. Accordingly, this structural overweight to stocks allows clients to benefit from their higher long-term expected returns relative to what is available in fixed income investments.

That said, multi-asset portfolios continue to benefit from an allocation to fixed income securities. In addition to providing income generation and serving as a repository for near-term cash needs, such investments offer portfolios ballast against an environment rife with risks to corporate profitability and investor sentiment. Beyond an unforeseen deterioration of domestic economic conditions, significant global risks remain. They include developments in Western Europe, where flagging economic growth is exacerbated by the continued headwinds borne by Russia’s invasion of Ukraine, in the Far East where China’s growth engine is sputtering and the country’s leadership continues to make noise regarding Taiwan’s independence, and in the Middle East where the current conflict threatens to further devolve into a larger regional war. As noted, with equity valuations generally reflecting optimistic views, a negative event or evolution in these areas could prompt a weakening of sentiment, and thus market conditions. Accordingly, we continue to position portfolios to achieve attractive returns while assuming only prudent levels of risk.

Boston Trust Walden Company is a Massachusetts-chartered bank and trust company. Past performance is not indicative of future results. Sources: Factset, Bloomberg, Standard & Poor’s, US Treasury, Board of Governors of the Federal Reserve, Federal Reserve Bank of Atlanta. Chart Source: US Bureau of Labor Statistics. The information presented should not be considered as an offer, investment advice, or a recommendation to buy or sell any particular security. The information presented has been prepared from sources and data we believe to be reliable, but we make no guarantee to its adequacy, accuracy, timeliness, or completeness. Opinions expressed herein are subject to change without notice or obligation to update.