Charitable organizations across the globe rely on the generosity of individuals like you to assist those in need, solve societal and environmental challenges, and fund innovation and research. In addition to supporting causes that you care about, charitable giving can also yield tax benefits.

Current tax code encourages charitable giving by offering tax benefits to donors. Under current tax rules, donations made to a qualified charity can be deducted on income tax returns, which may decrease your taxable income. To claim a charitable deduction, the recipient organization must be registered as a tax-exempt organization as defined by Section 501(c)(3) of the Internal Revenue Code. In addition, you cannot receive any goods or services in exchange for the donation. The IRS limits the amount of charitable contributions that you can deduct annually as an itemized deduction to a percentage of your adjusted gross income (“AGI”), as noted below.

Gifts to Public Charities:

- Cash: Up to 60% of your AGI

- Long-term appreciated property*: Up to 30% of your AGI based on fair market value

Gifts to Private Foundations:

- Cash: Up to 30% of your AGI

- Long-term appreciated property*: Up to 20% of your AGI based on fair market value

The AGI limitation applies to all charitable contributions you make throughout the year, no matter how many qualified charitable organizations you donate to. If your charitable contributions exceed the AGI limitation, you can carry forward the excess deduction for the next five years on your federal taxes.

*For securities, the holding period must be greater than one year.

So, how can you maximize the tax benefits of your charitable donations?

To answer this question, we will look at the three methods most often used to make donations: cash, appreciated securities, and contributions directly from an IRA.

Cash Donations: Convenient but not necessarily tax-efficient

The overwhelming majority of charitable contributions are made with cash. This is often due to the ease of using cash for both the donor and the recipient organization. However, convenience is where the benefit of donating cash ends. Other types of donations such as utilizing appreciated securities or making qualified charitable distributions from an individual retirement account offer additional tax benefits worth considering.

Appreciated Securities: Donations with additional benefits

Many charitable organizations will accept liquid securities such as stocks, ETFs, or mutual fund shares as donations. Further, when you donate appreciated securities, there is a dual tax benefit. First, you are eligible to claim a charitable deduction for the fair market value of the appreciated securities (subject to the AGI limitations detailed above). In addition, since you will be transferring appreciated securities to the charitable organization, rather than selling them and donating cash proceeds, you are able to avoid the capital gains tax liability. The recipient organization also will not have to pay taxes due to their nonprofit status.

For example, say you purchased 10 shares of XYZ company 15 years ago at a purchase price of $20 for a total cost of $200. Today, the shares are selling for $100 per share and your investment is worth $2,000. You can transfer those 10 shares to a charity, and you may claim an income tax deduction for the current market value of $2,000 (subject to AGI limitations). In addition to the $2,000 deduction, you avoid the capital gains tax that would have otherwise been due on the $1,800 increase in value since you purchased the shares for $200.

It is important to note that the security must have a holding period of more than one year. If you own appreciated securities for one year or less, the IRS considers this a short-term holding. For securities with a short-term holding period, the tax code limits the charitable income tax deduction to the purchase price of the security and not the current market value. Therefore, you should avoid donating appreciated securities with a short-term holding period. Similarly, you should not donate securities that have declined in value. Generally speaking, it is usually more valuable to sell the security and realize a capital loss for tax purposes.

Qualified Charitable Distributions (QCDs): An attractive solution (sometimes)

If you are 70½ years of age or older, you are eligible to make a QCD from your IRA (other than an ongoing SEP IRA or SIMPLE IRA). With a QCD, you can donate up to $100,000 each year to qualified charitable organizations. The benefits of QCDs are attractive — you avoid paying income tax on the amount donated and it counts toward your annual required minimum distribution for that year if you have reached the age at which the IRS requires distributions to commence. It is important to note that for this donation to qualify for the tax benefit, the funds must go directly from the IRA account administrator to a qualified charitable organization. For instance, the funds cannot be deposited into your checking account first, then contributed by you to the charitable organization.

While the QCD may seem attractive as income tax rates are higher than capital gains rates, often it is not the most tax-efficient strategy.

Which is best: Appreciated securities or QCDs?

As is true with most tax-related planning strategies, the option that may be best suited for you depends on your individual circumstances. However, there are some simple factors to consider:

- Are you at least age 70½?

- Do you itemize deductions or claim the standard deduction on your income tax return?

- Do you have appreciated securities outside of an IRA?

A strong determinant is whether you itemize deductions on your income tax return.

Since the Tax Cuts and Jobs Act of 2017 (the “Act”), most individuals are no longer itemizing deductions. Recall that the Act significantly increased the standard deduction from $6,500 per person to $12,000 per person ($13,850 in 2023 as indexed for inflation). At the same time, the tax law capped the deduction allowed for state and local taxes at $10,000 per household. Worth noting, a single filer is subject to the $10,000 cap, and a married couple filing joint is also subject to the same $10,000 cap. (In other words, it is not a per person amount.) The Act also suspended the deductibility of several other items that were previously deductible such as tax preparation fees and investment expenses.

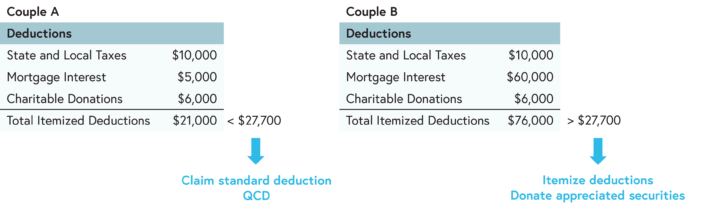

Consider the following example of two married couples, with similar incomes and minimum distribution requirements, filing a joint tax return:

In the case of Couple A, their itemized deductions add up to $21,000, which is less than the standard deduction of $27,700 (in 2023). Therefore, they are better off claiming the standard deduction. Note that if they had made no charitable contributions, they would still be able to claim the standard deduction. In essence, they did not get any tax benefit for their charitable contributions.

In contrast, Couple B has higher mortgage interest. They are above the threshold for the standard deduction based solely on their mortgage interest. They therefore realize the full benefit of their $6,000 in charitable contributions.

Whether or not you itemize deductions will be the determinant of which financial assets are the best to donate. Since Couple A is not going to itemize deductions, they should consider making a QCD instead of donating appreciated securities, as this would reduce their taxable income by $6,000.

In contrast, Couple B can contribute appreciated securities to a qualified charitable organization and realize the dual tax benefit of a tax deduction equal to the amount of the donation (subject to AGI limitations) and the benefit of avoiding the unrealized capital gains embedded in the securities.

Donor-advised funds can facilitate “bunching”

A donor-advised fund (“DAF”) is an account held by a financial institution. A DAF allows you to transfer appreciated securities to an account held in your name without triggering capital gains. A tax deduction may be claimed for the full fair market value of the transfer in the year it was made (subject to AGI limits). The funds within the DAF can then be distributed over any time period to qualified charitable organizations of your choice.

The goal of combining several years of charitable contributions in one year is to increase your itemized deductions. By doing so, your itemized deductions in this year will exceed the standard deduction. This facilitates using appreciated securities to realize the dual tax benefit. This strategy is referred to as “bunching” charitable contributions. In subsequent years, you would use the standard deduction as the threshold would not be met for using itemized deductions.

Coming up with a plan

If you are charitably inclined and want to maximize the benefit of your contributions for tax purposes, you will need a strategy personalized to your own financial circumstances and objectives. Your team at Boston Trust Walden can work with you, in conjunction with your tax planning professionals, to determine which charitable giving strategy is best suited to your circumstances.