Financial Markets

Stocks finished the first quarter with sizeable gains. This is particularly impressive given that investors contended with a hawkish Fed, turmoil in the banking industry, and declines in corporate earnings estimates. The S&P 500 Index, a broad measure of domestic large capitalization stocks, registered a return of 7.5% for the quarter, though there was considerable variation in returns over the quarter and among market segments. Financial stocks were unsurprisingly the worst performing sector, losing over 5% during the three-month period. Conversely, the stocks of large growth companies within the information technology and communications services sectors and highly cyclical companies within the consumer discretionary sector — all of which are perceived beneficiaries of the end of the Federal Reserve’s interest rate hike program — led the market higher.

Bond values also rose during the quarter as yields declined in response to the run on several banks. The Bloomberg Government/Credit Index returned 3.2% — a significant change from last year’s dismal negative returns — with bonds resuming their role as a provider of protection in times of uncertainty.

Most other market segments had positive returns. The Russell 2000® small capitalization index ended the period up 2.3% after a volatile quarter. Meanwhile, indices for developed and emerging international markets gained 8.0% and 4.0%, respectively.

Investment Perspectives

The biggest story of the past quarter was the turmoil within the banking sector. But to understand what transpired, we need to first appreciate how banks have been affected by recent economic conditions and the Federal Reserve’s monetary policy efforts. In short, the dramatic failure of two sizeable banks in the same week represented a tipping point that resulted from a combination of easy money flooding the banking system during the pandemic, the Fed’s monetary tightening over the past year to combat rising inflation, and a relatively unique group of depositors deciding to pull their money from a bank that was particularly vulnerable.

A core component of the banking business model is that banks accept deposits and pay interest on them, while simultaneously extending loans for which they receive a higher rate. The difference between the interest collected from loans and paid on deposits, called “net interest income,” is a primary driver of bank profits. But this business model has risks. A primary one is that depositors can withdraw their funds at any time, while a bank’s investments (including extended loans) are generally long-term in nature.

With consumers flush with cash, banks had enjoyed significant deposit growth in recent years. Some more than others. For example, with a focus on serving technology start-ups and the venture capital crowd, exceptional deposit growth catapulted Silicon Valley Bank (SVB) to become the 16th largest bank in the US. On its own, the surge in deposits was not an issue; however, what SVB executives did with that new capital set the bank up for trouble. They chose to invest much of their newfound capital in ‘safe’ US Treasury bonds and other debt backed by the US government; but while such bonds are peerless in their credit quality given the guarantee they will be paid back at maturity, their value can decline in the interim if interest rates rise.

Unfortunately, interest rates did rise. As the Fed’s inflation-fighting efforts drove rates higher and bond prices lower, SVB’s large bond portfolio lost significant value. And suddenly, a bank darling that had been flush with cash became one that needed to raise capital. SVB’s efforts to shore up its balance sheet created panic within the highly interconnected venture capital world, and those depositors began pulling their money out en masse. It was a classic bank run, though arguably the first in the age of social media and easily accessible banking apps. Ironically, SVB’s popularity among a tech savvy clientele likely helped to sow the seeds of its own demise. A similar fate befell Signature Bank shortly thereafter. The primary difference being that Signature had catered to — and enjoyed deposit growth from — the suddenly struggling cryptocurrency industry. Other banks with rapid deposit growth or concentrated customer exposure also came under pressure.

Though the mere mention of bank failure brings comparisons to the Great Financial Crisis, the similarities between these events are minimal. The many bank failures circa 2008 involved highly complex financial instruments (which the purveyors often did not fully understand), less regulation, and more financial leverage — all of which combined to make the financial system seize. This contrasts against the recent bank failures which involved poor decision-making and risk management among a small group of banks. There is also more transparency into the underlying issues, and more cushion — in the form of capital — that banks hold. Importantly, the Treasury, Fed, and Federal Deposit Insurance Corporation (FDIC) stepped in swiftly and decisively with a collective commitment to backstop the issue and limit broader contagion in the sector.

We expect any further bank failures to be limited. However, the events of the last month do highlight the systemic challenges in the sector, and by extension, the economy. One lesson is that the mismatch between bank assets and liabilities continues to be a primary driver of risk, and published figures on bank capital ratios do not always capture how risky a bank truly is. With regulators and the public more actively monitoring the banks’ underlying risks, they may be less willing to lend, leading to less credit available to consumers and businesses and deteriorating economic conditions. In turn, a poorer economy raises risks associated with the credit quality of outstanding loans (i.e., borrowers’ ability to repay loans if their fortunes suffer), which further clouds the outlook for banks and the economy. Thus, in the medium term, this episode has increased the risk of a slowdown in GDP growth and the possibility of a recession.

The Fed Adapts

Though the distress within the banking sector rightfully stole news headlines in March, the Fed’s monetary policy actions remain key for financial markets. Just prior to the recent banking events, a prominent inflation reading came in materially higher than expected. The data presented a disruption in the slow-but-steady progress the Fed had made in cooling pricing pressures. And despite previous headway, evidence of still-persistent inflation had investors and economists bracing for the Fed to re-escalate the magnitude of their interest rate hikes.

Though idiosyncratic in nature, the collapse of SVB and Signature revealed that the Fed’s tightening efforts had inadvertently created stress elsewhere in the economy. Fed Chairman Jerome Powell readily acknowledged this in comments following a policy meeting less than two weeks after the turmoil struck. Accordingly, the Fed slowed the pace of its monetary tightening relative to what had been previously expected. Nonetheless, the Fed did not shy away from maintaining its focus on bringing inflation down to the target 2% rate over time.

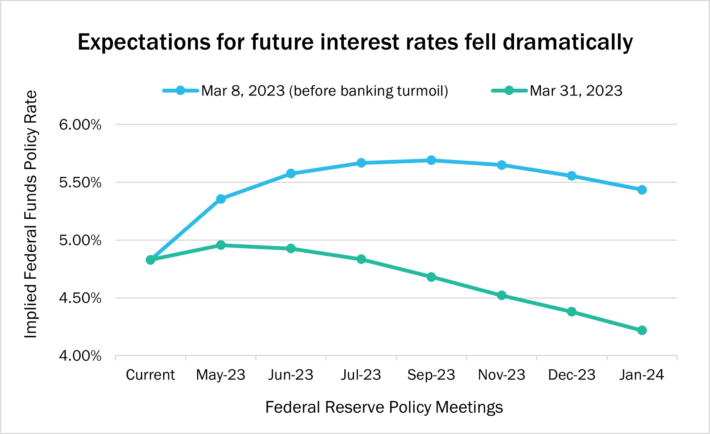

Source: Bloomberg/Federal Funds Futures

Given its recency, the impact of the banking woes has yet to show up materially in economic data. Though when we look at market-based readings of future Fed actions, it appears expectations for any significant further Fed Funds rate increases have all but disappeared. Going further, and as shown in the chart, investors now forecast materially lower rates in the future. The latter effectively implies an expectation of economic cooling, for which the Fed will need to reverse course.

Outlook and Positioning

Banking conditions provide the backdrop for a dimmer economic outlook, but not all economic news has been poor. For one, the ever-important labor market remains robust — a significant factor in the resilience of consumer spending. Though the headline unemployment rate ticked up in recent readings, it did so for a good reason: more people joined the workforce and were looking for jobs. Such an evolution is positive as it can serve to further slow the pace of wage increases — and inflation — without the necessity of job losses.

The first quarter provided a reminder that shifting economic conditions do not necessarily translate directly into equity performance, and that not all stocks are created equal. The current climate favors our long-held investment philosophy: namely, seeking companies that have sustainable business models that can produce healthy profits and cash flows in a range of economic conditions. Though additional rate hikes from the Fed may be limited, corporations are operating in a different interest rate environment than they have for the last decade. It would not be surprising to see further stress related to interest rates reveal itself. Accordingly, we remain focused on owning shares of those companies that have prudently managed their debt levels and whose businesses are not dependent on exceptionally low borrowing rates.

At the same time, the recent quarter reminds us of the invaluable role high quality bonds can play in multi-asset portfolios — providing a ballast should unforeseen events, whether economic or geopolitical, unfold. And unlike much of the past decade, high quality bonds now offer appreciable yields while also providing a level of portfolio protection.