Since 1975, Boston Trust Walden has integrated environmental, social, and governance (ESG) considerations into investment decision-making on behalf of our clients — one of the longest track records of any institutional investment manager. As an active manager, ESG considerations are integral to our investment philosophy and part of our fiduciary duty to ensure client assets are invested in a set of securities that we believe to be well-positioned to minimize risk and produce sustainable returns. To be competitive, companies must effectively manage material ESG risks and capitalize on emerging opportunities.

Thus, a core component of our equity research process is recognizing the financial materiality (or significance) of ESG-related risks and opportunities for a potential investment. For companies considered for investment in client portfolios, an ESG investment analyst and traditional securities analyst review the company simultaneously and collaboratively. We illustrate this process below using a case study of the company Watts Water Technologies.

Company Overview

Watts Water Technologies (Watts) is an industrial products manufacturer. The company designs and produces valve systems that safeguard and regulate water systems, energy-efficient heating systems, drainage systems, and water filtration technology that helps purify and conserve water. Watts frames its product solutions as offering three main benefits to customers — notably safety and regulation, energy efficiency, and water conservation. The total market for its products continues to grow and was recently estimated to be approximately $20 billion.

Our Analysis

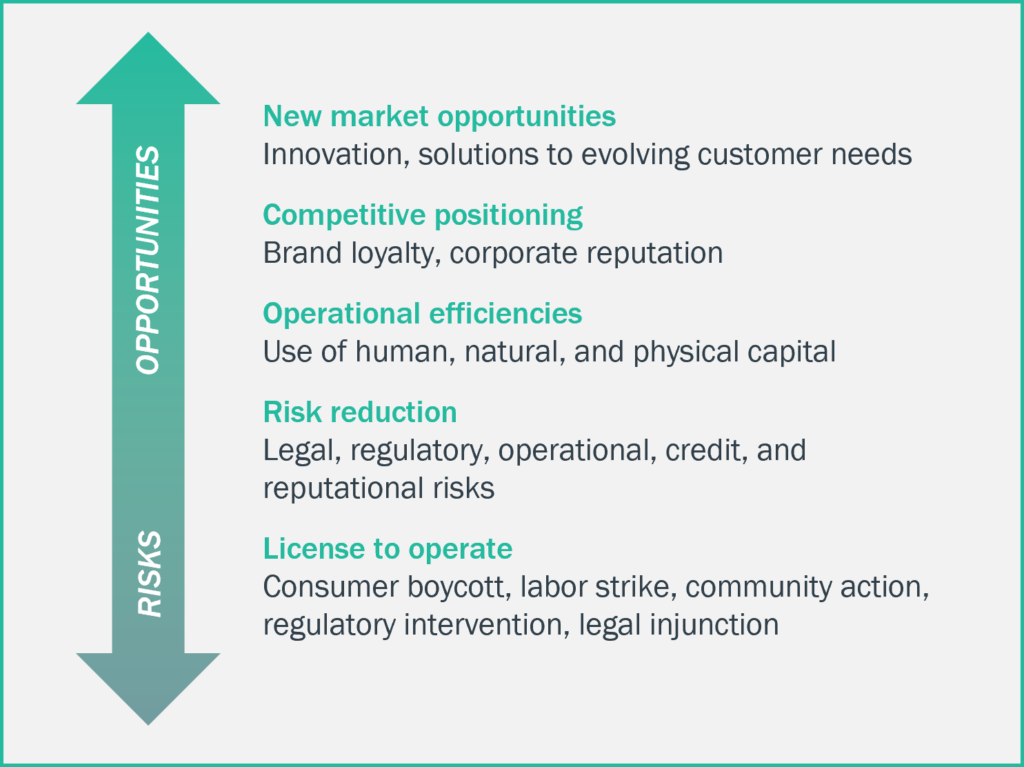

For potential investments, Boston Trust Walden ESG investment analysts and traditional securities analysts work together to evaluate a company’s performance with two objectives in mind: 1) to enhance our understanding of potential financial outcomes associated with issues ranging from risks (e.g., physical risks to operations) to opportunities (e.g., generating new sources of revenue); and 2) to identify potential ESG risks and opportunities for further investigation, recognizing ESG factors can be positive, neutral, or negative. Issues range from broad sector considerations to company-specific items and are informed by potentially material ESG issues, as identified by the Sustainability Accounting Standards Board (SASB), in addition to our own knowledge and experience.

Watts competes in a highly fragmented industry with numerous competitors. It has carved out leadership positions in some geographies and product categories. Its market leadership is driven by its high quality products and strong reputation, which gives the company sustainable pricing power. Historically, among Watt’s peer group, there has been a wide range of product cost and quality. Approximately 60% of Watts’s annual sales are highly stable, derived from products used to repair and replace existing equipment. The remaining 40% of sales are exposed to new construction, which is a large market but inherently more volatile with economic cycles. The company operates through four segments. In 2023, Residential & Commercial Flow Control accounted for 56% of sales; HVAC & Gas products, 29% of sales; Drainage & Water Reuse, 9% of sales; and Water Quality Products, 5% of sales.

Understanding the ESG Risks and Opportunities

Potential risks and opportunities for industrial manufacturers commonly include quality control, waste management, labor conditions, and material sourcing. In the case of Watts, our research revealed the business model focuses on products that emphasize safety and regulation, energy efficiency, and water conservation. We noted that these facets of the Watts business model presented potential new market opportunities as customers prioritize these attributes. Moreover, we also noted the company’s efficient use of resources in the manufacturing process. Effective management of resources is a cost-saving opportunity, translating to margin expansion for the company.

For Watts, a strategic focus of the business has been to build out the company’s “Smart & Connected” products. This cohort of products climbed from 9% of sales in 2019 to 25% by the end of 2023. These products reflect technological advances in Watts’s capabilities when compared with legacy products and competitor offerings. While the cost to develop these products is not immaterial, “Smart & Connected” products earn a premium price in the market as they enable customers to better understand their resource utilization and manage operating expenses.

Watts also sells a wide range of water and energy-efficiency products for commercial and residential customers. Notably, 37% of Watt’s gross product revenue comes from products like pressure-reducing valves and overflow protectors that help customers conserve water, 24% from products like boilers and heat pumps that improve energy efficiency, and nearly 75% from products that improve user safety and ensure regulatory compliance.

The shift to both “Smart & Connected” and resource-efficient products unlocked new market opportunities. The value these products provide earned recognition among customers who, in turn, demonstrated a higher willingness to pay for these new premium products. Our analysis revealed that margins had climbed by more than 10% in the last decade.

Further, analysts noted resource usage, greenhouse gas emissions (GHG), and efficiency in the manufacturing process had markedly improved over time. In 2018, Watts established a goal to reduce GHG emissions intensity 12% by 2022 against a 2018 baseline. The company successfully delivered a 49% reduction driven by facility efficiency gains and increased use of renewable energy credits in the same period. Similarly, Watts established a target of a 12% reduction in water intensity and far surpassed that goal, delivering a 62% improvement. These initiatives contributed to margin improvement and enhanced the financial quality of the business.

Our Investment Decision

Boston Trust Walden makes active investment decisions based on our assessment of financial quality, the durability of the business model, and valuation. Our analysis of ESG risks and opportunities informed our view of Watts’s operational strengths and weaknesses. Our research revealed strong underlying fundamentals, in part driven by an efficient manufacturing process that conserves resources, and a portfolio of products that benefits from numerous ESG tailwinds.

With this ESG opportunity and risk mitigation information, we determined the company’s improving margin profile was likely sustainable over our investment time horizon. That view informed our conclusion that the valuation was attractive. Ultimately, our Securities Research Committee concurred with the analysts’ recommendation to retain Watts on the Boston Trust Walden approved list for client portfolios.

In Summary

ESG risks and opportunities can affect corporate performance and ESG analysis played a crucial role in our assessment of Watts Water Technologies. We believe it is prudent to recognize the financial materiality of ESG issues, and Boston Trust Walden is committed to doing so as we seek to invest client assets in a set of securities well situated to minimize risk and produce durable returns.