For investors with short- to intermediate-term cash needs, determining the appropriate amount of liquidity to hold is a crucial and often difficult decision. The idea that something seemingly as innocuous as cash or short-term bonds could have an important bearing on portfolio outcomes may strike some as peculiar, particularly as a spate of major economic and geopolitical events are dramatically impacting financial asset prices. However, investors would be wise not to dismiss the importance of a sound strategy to address spending needs. Carrying too much or too little liquidity can jeopardize the likelihood of achieving longer-term financial objectives.

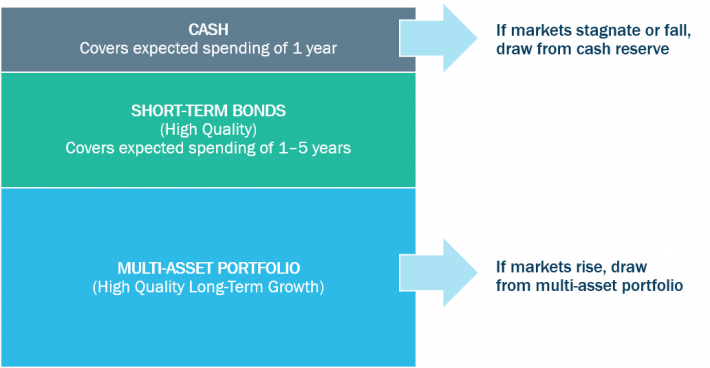

Our team at Boston Trust Walden has found that, in concert with an appropriate level of spending, establishing and managing a reserve can effectively serve to meet the tricky balance of satisfying near-term needs, enduring market setbacks, and positioning a portfolio to adequately grow. The concept is to insulate a number of years’ worth of anticipated spending in cash and highly liquid investment grade bonds, with the remainder of assets invested in a multi-asset portfolio geared toward longer-term growth. If markets rise and tax considerations allow, the client draws from the appreciated assets, leaving the reserve intact. If, however, markets are in decline, the client would draw on the more stable reserve.

The benefits of establishing a spending reserve are two-fold:

- First, by setting aside funds to cover expenditures, investors are not forced to sell securities at depressed levels when market volatility inevitably arises. After all, the real risk to investors comes not from fluctuating market prices but rather the permanent destruction of capital that is realized when a security with long-term merit must be sold at an inopportune time to provide liquidity.

- The second benefit is more psychological in nature but with very real financial consequences. Market volatility, especially at its extremes (e.g. the Financial Crisis, COVID-19), naturally leads to anxiety about one’s financial security. Investors may project one level of risk tolerance during more placid market environments, only to find it quite difficult to control their emotions when near-term economic prospects dim. In this instance, they sell, not out of need but out of fear. That instinctive response can lead to poor asset allocation decisions with dire repercussions to portfolio longevity. With a sufficient reserve in place, investors are much more likely to stay invested, escaping the temptation to try to time the market and simply allowing asset values to recover.

Constructing a spending reserve is not an exact science that lends to a one-size-fits-all solution. We typically recommend that clients segment an amount equal to two to six years of anticipated cash needs. However, as is evident in the range, the implementation varies with client circumstances. Ultimately, an effective reserve will reflect an intersection of market history, economic outlook, spending level, and client preference. It will be the product of direct and ongoing communication between a client and their investment team at Boston Trust Walden.