Financial Markets

Over the course of 2022, financial markets grappled with the continued reverberations of the pandemic’s impact on the economy and compounding effects from jarring geopolitical strife. The domestic economy began the year with a continuation of 2021’s spirited rebound, fueled in part by lingering fiscal and monetary policy support. However, consumers and central bankers alike soon increased their focus on enduring inflationary pressures, made more acute with the rise in commodity prices due to Russia’s invasion of Ukraine in the first quarter.

The consequent about-face in monetary policy – with the Federal Reserve aggressively increasing interest rates by 4.25 percentage points to combat inflation after having spent much of 2021 suggesting such forces were “transitory” – was the story of the year in financial markets. The Fed’s action had its desired effect on pockets of the economy, for instance a marked cooling of the housing market, but its intention of slowing broad-based inflation has taken longer to develop. Nonetheless, higher interest rates factored into a highly correlated re-pricing of most financial assets – with primary stock and bond indices both registering double digit losses in 2022. As tightening financial conditions translated to expectations of falling demand and slower economic growth, the S&P 500 posted a total return of -18.1% for the year. The drop in stocks was led by those reliant on ultra-low interest rates – either as it relates to overleveraged balance sheets or sky-high valuations predicated on exorbitant growth expectations. At the same time, bonds did not offer their typical port in the storm as higher interest rates directly translated to lower prices; the Bloomberg Government/Credit Index lost 13.6% in 2022. International markets also fell with the MSCI World ex-US (Developed Markets) Index losing 14.3% and the MSCI Emerging Market Index dropping 20.1%.

Though full year returns were dismal, the fourth quarter did offer a reprieve. The S&P 500 gained 7.6%, while bond indices also posted positive returns in the final three months of the year. The rally signaled that investors believe the worst may be behind us. We agree. Indeed, the last several headline prints of the Consumer Price Index (CPI) and Producer Price Index (PPI) were relatively benign – indicating that inflationary pressure may finally be beginning to normalize. Accordingly, it is likely that the Fed will be less aggressive in hiking interest rates on a go-forward basis, perhaps allowing for the highly sought economic “soft landing.” That said, the risk of persistent inflation has not been fully squashed, leaving investors with plenty of uncertainty as we head into 2023.

Investment Perspectives

The path of financial markets was anything but smooth in 2022. Though myriad factors influenced the ebb and flow of asset values, their fluctuations were largely a reflection of investors’ reactions to macroeconomic data on inflation and evolving monetary policy. To better understand these forces at work, it is necessary to dig into the underlying components of inflation.

Components of Inflation

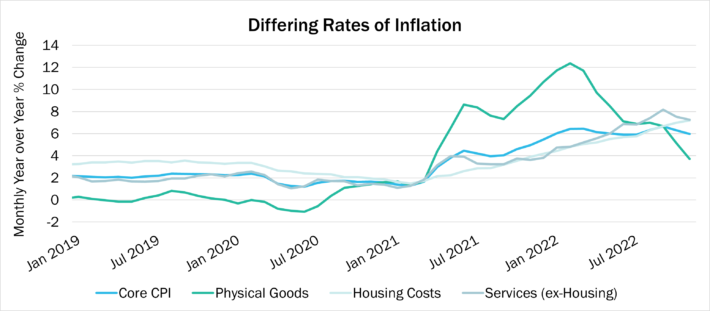

Reported inflation figures like the Consumer Price Index (CPI) or Personal Consumption Expenditures (PCE) are comprised of a wide basket of goods and services. As one would expect, prices of those components do not move in unison. Their paths, as shown in the below exhibit, offer some clues as to what we might expect in the future from prices, and in turn, the Fed.

First, it’s worth noting that economists and policymakers tend to focus on “core” inflation measures, or those that strip out the volatile prices of food and energy. Though this is not intuitive given the substantial portion of spending that goes towards these commodities – especially for those with lower incomes – their price fluctuations are not typically tied to long-term issues. Rather, they often reflect exogenous events, for instance Russia’s invasion of Ukraine, that are expected to resolve in time. Accordingly, we will focus on such core measures here as well.

As covered in previous commentaries, prices of physical goods were the first and fastest to rise during the pandemic after an initial dip in early 2020. Prices for such goods jumped as heightened demand from consumers confined to their homes met supply chains that were roiled by pandemic-related disruptions. As the pandemic waned, consumer activities – and spending patterns – began to return to normal, and supply chain constraints subsided. Accordingly, goods-related inflation abated sharply in 2022 and is poised to moderate further in 2023.

Housing is another component of spending that has experienced significant pricing swings over the past three years. Economic measures of “rent” include rent as well as “rental-equivalent” for the estimated cost of an owner-occupied dwelling (this is a more dynamic data point than capturing the cost via a home sale, which typically occurs infrequently). Though the estimation of such costs can be fuzzy, it is clear that measures of rental inflation have yet to slow. Part of this is due to the nature of housing: as rental leases take longer to turn over, an inflection point in such pricing lags other inflation metrics. However, measuring rates on new leases provides a timelier reading of rental pricing, and an indication of forthcoming trends. According to a host of rental market data providers, year-over-year increases of new rentals were peaking in the high teens toward the end of 2021 but had begun to slow sharply by the middle of 2022. Though annual housing services inflation figures are still including the uptrend, and likely will well into 2023, we should see the current cooling reveal itself in inflation data later in the year.

Core services, excluding housing but including everything from healthcare to education to hospitality and many others in between, remain the proverbial wildcard in the inflation landscape. For one, in our services-based economy, this category comprises over half of spending in the US. Also key is that wages constitute the largest input cost in delivering these services. Accordingly, the employment picture is critical in discerning what might be to come in services inflation, and part in parcel of why every data point that reveals the evolution of the labor market is intensely scrutinized by investors. Simply put, despite the Fed’s efforts to raise borrowing costs and in turn cool the economy’s growth, the job market has remained remarkably robust. Job openings continue to outstrip job seekers by almost a 2-to-1 margin, the overall unemployment rate remains near its lows, and wage gains are still close to their multi-decade highs.

The future trend in wage inflation will be critical in determining how persistent overall inflation may be and will heavily influence future Fed policy. Fed Chairman Powell has stated that the Fed is monitoring this area closely, and that the labor market will need to cool in order to bring inflation down to its long-term target of 2%. Thus, each data release related to wages and the labor market is likely to continue to have an outsized effect on expectations for future interest rates, and in turn, on asset prices.

International Challenges

Other developed economies are facing similar challenges as the US but have their own unique circumstances. Europe is facing widespread impacts from the ongoing Russia-Ukraine conflict. Disruptions to energy and food supplies have pushed such prices sharply higher, stoking inflationary pressure and hurting other parts of the economy. Accordingly, the European Central Bank (ECB) has the challenging task of combating high inflation with an economy that is already stagnating. Though increasing interest rates is the natural response to cool inflation, the tighter financial conditions could portend a deeper economic downtrend for the region. Besides direct impacts to Europe, such an outcome has implications for the global economy – and global corporate profits – given the region’s collective size and aggregate economic demand.

In China, after stringent lockdown policies largely prevented widespread COVID outbreaks for much of the pandemic, a loosening of restrictions in the fourth quarter allowed the virus to gain a footing in the country’s massive population centers. Though many companies that leverage cheaper international labor have spent the last couple years trying to address vulnerabilities in their supply chains, China remains the world’s manufacturing powerhouse and any disruptions to operations could have economic impacts. Separately, the country’s continued assertive stance towards Taiwan is another reminder of how geopolitical maneuverings on the other side of the globe present clear risks to the domestic economy. As Taiwan is the world’s largest supplier of semiconductors, any disruption in trade could have profound effect on many products and supply chains; in fact, the threat against Taiwan is already affecting the world, as the US and other global powers have begun to pivot away from globalization and global supply chains for critical components.

Outlook and Positioning

The most prominent unknown facing economists and investors today is what impact will inflationary pressure, and the Fed’s actions to subdue it, ultimately have on the economy. Many pundits are now trying to predict whether there will be a recession in 2023, and perhaps, if the Fed will change policy course again to reinitiate economic growth. But we are less concerned with whether the economy officially enters a recession or the exact path of Fed policy rates. Instead, we are focused on the prospective profile of such a downturn in economic activity. To wit, given the resiliency of the labor market, still-elevated consumer savings balances, and enduring consumer spending, we don’t expect a deep or extended recession should one occur. Such an outcome would bode well for a smooth transition into a more normal economic cycle in the longer term.

Another primary uncertainty for investors relating to this prospective slowdown is the impact on corporate profits. In aggregate, S&P 500 earnings are expected to have grown by almost 6% in 2022. Though a far cry from the almost 50% increase in 2021 (off depressed 2020 results), such growth represents a healthy expansion of corporate profits. Despite the downtrend in stock prices and forecasts for further economic slowing, analysts still expect collective earnings growth of roughly 5% in 2023. Thus, in aggregate, stock valuations have become materially cheaper relative to corporate profits. More attractive valuation, alongside the resilience of corporate earnings power, underlies our preference for equities in multi-asset portfolios. This is especially true for those companies with sustainable business models, pricing power, and underlying financial strength that we favor.

One market attribute from 2022 we expect to carry over into 2023 is heightened volatility. The highly dynamic environment, both economically as well as in terms of broader geopolitical issues, provides the backdrop for investors to react sharply to any new information. We expect bonds to provide a ballast to portfolio values as they have in most such historical periods, and the newly higher interest rates also allow for fixed income investments to augment prospective portfolio returns.